What is the financial health of this company?

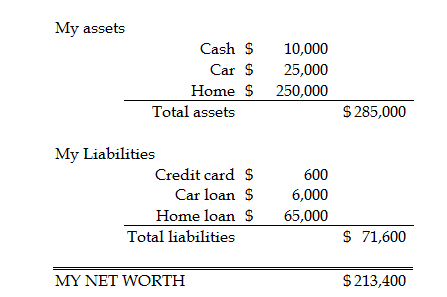

What would you tell me if I asked you what your net worth or financial position is today? You would list out all your assets, which may include cash, stocks, automobiles, homes, land, etc. You would also list out your liabilities or amounts you owe others which may include credit card dues, car loans, home mortgages, etc. Finally, you would subtract your liabilities from your assets, and that is your net worth.

An illustration, for example, may look like this:

If I were to ask a company that question, I might be given the balance sheet as a response.

The balance sheet gives me perspective on the financial health of the company. It lists out the assets and liabilities of the company. It also shows me the net worth of the shareholders (book value). I should be able to answer the following questions after I review the income statement of a company:

- What are the assets of the company as on the balance sheet date?

- What is the total value of the assets?

- Who does the company owe money to?

- What is the total amount of money owed to others?

- How much money did the shareholders invest in the company?

- How much money did the company generate for the shareholders?

- What is the net worth of the company?

Overview of the Balance Sheet

I first study the heading of the balance sheet. It should provide me three pieces of information. First is the date of the balance sheet: The balance sheet provides the financial position of a company as on a particular date. Balance sheets usually provide figures for two periods – usually the beginning and the end of the period. Second is the unit of measurement: The reported figures may be in thousands or millions. And third, the currency in which the figures are reported: most firms will provide their report in US Dollars. However, other firms may report their numbers in their respective home currencies.

Apple’s balance sheet in its 2011 Annual report is reporting on the financial state of the company at two points in time, specifically on September 24, 2011, and September 25, 2010. We can also see that all the figures are presented in millions except the number of shares which is reported in thousands. Since Apple is a US-based company, it reports its figures in US dollars. What do you notice first when you look at the balance sheets of Google, Wal-Mart, or American Airlines?

The balance sheet can be looked at as three lists. The first list is a list of assets of the company. An asset is defined to be any current or future economic resource of the company. This could be money owed to the company, land or buildings owned, rights to mining or other resources, patents or trademarks, or anything else of value.

Illustration of three lists

The second list is a list of liabilities or amounts the company owes others. A company could owe money to its suppliers or employees. A company could also owe interest and principal payments to banks or other institutions it has borrowed from.

The third list is usually titled Shareholders Equity. This list usually contains the amounts investors or owners have contributed to the company. It also shows the profits (or losses) that the company has made but not paid out to its shareholders or owners and is usually labeled retained earnings.

Assets = liabilities + shareholders equities

The basic accounting equation states that the sum of the values in the assets list must equal the sum of the values in the liabilities and shareholders’ equity lists. This equation follows all the rules of algebra and can be rearranged in any convenient form. For example, this equation is rearranged to get the net worth of the company as follows.

Illustration of A = L+E and A-L = E (net worth) etc.

In the case of Apple we see that

Assets = Liabilities + Shareholders Equities

A = L + E

A ($116,371) = L(39,756) + E (76,615)

Or alternatively

Assets – Liabilities = Shareholders Equity

A – L = E

A ($116,371) – L(39,756) = E (76,615)

Let’s look at the three lists in a balance sheet in more detail.

Assets Side of a Balance Sheet

An asset is defined to be any current or future economic resource of the company. This could be money owed to the company, land or buildings, rights to mining or other resources, patents or trademarks, or anything else of value.

The assets list is classified into two categories: current assets and long-term assets. The current assets are usually assets that can be converted into cash quickly. In contrast, long-term assets are assets that cannot be converted into cash quickly and are intended to be used by the company over a longer period. Examples of current assets include cash, accounts receivables, inventory, bonds, and stocks which can easily be converted into cash. Examples of long-term assets include land, building, machinery, etc., which are used by the business over the long term.

Apple’s current assets list has six items listed for a total of $45 billion. Its long-term assets have $71 billion listed, which gives $116 billion of total assets. What are the assets of Google, Wal-Mart, and American Airlines?

You have to be careful interpreting the asset side of the balance sheet because of serious limitations in financial accounting. Financial accounting regulations require companies to follow specific rules when it comes to valuing assets. These rules could cause anomalies that we must be aware of.

Some assets like land are recorded at historical values as values do not depreciate. This means if Apple bought land for its factories 20 years ago, the value of land would be reflected in its balance sheets at the price it paid for the land 20 years ago. The value of the land probably has appreciated considerably since then. This appreciation will not be reflected in Apple’s balance sheet because accounting rules require you to record land at historical cost except under certain conditions.

Some assets are recorded at ‘net cost.’ Net cost is historical cost reduced in value ‘according to its use.’ This process of adjusting historical costs according to their use is called depreciation. For example, if a machine was purchased for $100,000 and was intended for use for 10 years, its value would be decreased (depreciated) by $10,000 each year that it is in use. Other assets have specific guidelines too. For example, inventories must be valued at lower of cost or market prices.

We must keep in mind that the value of assets listed in a balance sheet may not be the true value of the assets in the market today. Therefore, we must recognize that the value of the figures in the balance sheet will not reflect the true value of a company as a whole. The share holder’s equity is only the net book value of the business.

The valuation of a company is not something that we will address in this article. The ABCs of DCF Valuation and Modeling – Simplified will give you a good introduction to the concept of valuation and modeling.

Liabilities Section of a Balance Sheet

Liabilities are what the company owes other people. A company could owe money to its suppliers, or employees, or other third parties. A company also owes interest and principal payments to banks or other institutions it has borrowed from. The liabilities section is broken down into current liabilities and long-term liabilities. Current liabilities are liabilities that the company is obligated to pay in the short term (usually considered to be 12 months). Long-term liabilities are liabilities that the company is not obligated to pay in the short term.

Apple’s current liabilities list has three items listed for a total of $28 billion. Its long-term liabilities are listed at $12 billion, which gives $40 billion of total liabilities. What are the liabilities you see in the balance sheet of Google, Wal-Mart, and American Airlines?

Shareholders’ Equity Section of a Balance Sheet

The shareholders’ equity section of the balance sheet shows the amount of money attributable to the shareholders. The first part of this section usually shows the common stock or the amount of money paid by the shareholders to receive shares of the company. This section will also highlight the number of shares that the company is authorized to issue and the number of shares the company has issued so far.

We can see that although Apple has been authorized to issue 1,800 million shares, it has only issued 930 million shares as of September 24, 2011. We can also see that the shareholders have paid $13.3 billion to the company in return for the shares.

Retained earnings are the next component of this section. Retained earnings reflect the amount of net income retained by the company instead of being paid to shareholders as dividends. Companies retain profits instead of paying back to shareholders to reinvest into the business.

We see that Apple has about $63 billion of profits that have not been paid out to shareholders. These profits not paid out are classified as retained earnings. What are the retained earnings you note for Google, Wal-Mart, and American Airlines?

Often this section will also contain a line called “accumulated other comprehensive income.” These are usually amounts that have not flowed in through the income statement. We will not review the accumulated other comprehensive income figure at this level.

Evaluating the Financial Health of the Company

Now that you understand the three components of a balance sheet let us look at how to read the balance sheet to understand the financial health of a company!

A company can be said to be financially healthy if it can repay its debt obligation comfortably. The liabilities section of the balance sheet will list out the liabilities. While we want the company to be able to address both the short-term liabilities and long-term liabilities, we are most interested in the long-term liabilities – usually debt owed to banks and institutions. This is because these debtors have the power to force you into bankruptcy.

While the balance sheet provides you insight into the quantity of debt, it will be insufficient to decide on the financial health of a company. You must also read the income statements and understand the cash flow statements. These statements show you how much money the company earns to repay the debt.

Please note that it is NOT the quantity of the debt that is important. It is the ability of the company to repay its debt obligations that you are evaluating. As long as the company can repay its debt obligations comfortably, it can be said to be financially healthy.

How to Read a Balance Sheet Summary

The balance sheet reflects the financial health of the company as on the date of the balance sheet. The balance sheet can be looked at as three lists. The first list is a list of assets of the company. Assets are defined to be any current or future economic resources of the company. The second list is a list of liabilities or amounts the company owes others. A company could owe money to its suppliers or employees, or financial institutions. The third list, called shareholders’ equity, reflects amounts investors or owners have contributed to the company in exchange for shares as well as the retained earnings, which is the profit retained by the company to fund further investment. If I could only take away three facts after reviewing the balance sheet, it would be:

- What is the value of assets owned by the company?

- What is the value of liabilities owed by the company?

- What is the net worth of the company?

Next Steps: Now that you have a good understanding of what is in a balance sheet and how to read balance sheets in a company’s annual report, why don’t you head over to either:

- Learn how to read an income statement;

- Learn how to read a cash flow statement; or

- Learn how to understand and interpret percentage statements.

If you are looking to build or model financial statements in Microsoft Excel, look no further than our collection of books here.

- Modeling Projected Financial Statements (Without a Plug!);

- Modeling Leveraged Buyouts – Simplified!;

- The ABCs of DCF Valuation and Modeling;

- 101 Private Equity & Investment Banking Interview Questions & Answers.

Email or call us or simply fill out the sign-up form below if we can assist you with live one-on-one tutoring on any business topic.