Understanding Transfer Pricing

Understanding transfer pricing is important for senior managers in large organizations because it impacts profitability and performance of the organization. Transfer pricing should aligned with the local laws, international tax treaties, corporate structure and employee incentives design.

Our accounting tutors tutor MBA, CPA and CFA students on a variety of transfer pricing topics and case studies. Transfer pricing topics can be broadly classified into two segments:

- International Transfer Pricing: Cross border transfer pricing impacting profits and taxation.

- Intra-company Transfer Pricing: Intercompany transfer pricing usually impacting segment profitability, incentive systems & bonuses.

We address both cross border transfer pricing of these broadly in this page.

Tutoring for International Transfer Pricing

Multinational companies operate in many countries by setting up subsidiaries in each country. These subsidiaries are governed by the local corporate and tax laws. Tax laws will be different in different countries. This is fine and expected. However, countries also sign bilateral agreements to prevent double taxation called double tax avoidance agreements (DTAA). These agreements specify tax regulations for companies operating between the signatory countries. DTAA regulations include different tax treatments for certain kinds of income such as interest, dividends, royalties, etc. For example, royalty income may be taxed at a specific rate, or interest income may be taxed by only the host country and not the other country, etc. Here is where transfer pricing complications come in. Let’s illustrate this with an example.

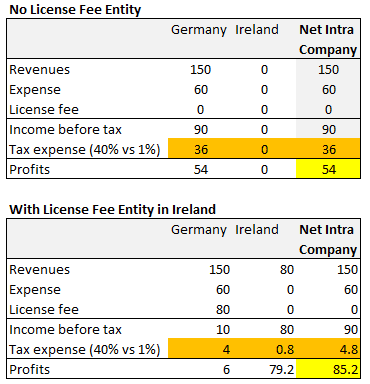

Let’s say a company has a subsidiary in Germany. This subsidiary has revenues expenses in profits in Germany. These profits are taxed at a tax rate of 40% in Germany, illustrated below.

Germany and Ireland have a bilateral double tax avoidance agreement. Let us assume that the DTAA specifies license/royalty paid to companies in Ireland are tax deductible in Germany, and in Ireland, such license/royalty income is taxed at a rate of 1%. Now the German subsidiary can sign a contract with its Irish subsidiary offering to pay a license fee to the Irish subsidiary. This contract reduces profits and the tax paid of the German subsidiary significantly. The Irish subsidiary will be a profitable company with royalty income. But the royalty income is taxed at 1% in Ireland instead of 40% in Germany (due to the double tax avoidance agreement). This results in a lower tax for the consolidated entity.

This transfer pricing illustration is not far from the truth; There has been controversy over companies avoiding taxes in different jurisdictions. Tech companies pay low taxes in the US because their profits are retained in low-tax countries like Ireland. Read more about Apple’s Double Irish with Dutch Sandwich tax structure that leverages transfer pricing to reduce taxes. Non-tech companies also play this game. For example, Starbucks paid little or no tax in the UK around 2012 because most of their profits in the UK subsidiary went to their Dutch subsidiary as a license fee! These license fees are transfer prices set with the objective of minimizing taxation. Governments will continue to try and fight this kind of structures. However, local employees will not be happy because their bonuses are based on the profits of their subsidiaries. To address this, there is another set of books for internal cost accounting, and incentive structures and another set of books often referred to as the tax books for reporting purposes.

Transfer Pricing Tutoring for Intra Company/Division Sales

Transfer pricing also becomes very important for companies with multiple divisions or profit centers. Different ways in which transfer pricing becomes relevant are: valuation of internal transactions, segment profitability, reporting of taxable income for business segments, allocation of overheads, etc.

Methods for Setting Transfer Prices

There are primarily two methods for setting transfer prices between divisions of a company.

- Market-based transfer pricing methods; and

- Cost-based transfer pricing methods.

Both market-based transfer pricing methods and cost-based transfer pricing methods have their advantages and disadvantages.

Market-Based Methods

Market place methods of setting internal transfer pricing within companies include:

- The market price,

- Market price minus intracompany discounts; and

- Negotiated prices.

The advantage of marketplace pricing is a sense of fairness and reasonableness between the participants within a company. Market pricing also encourages managers to be competitive and innovate continuously. Other factors also need to be considered in using the market price as the transfer price within a company. Other factors include capacity utilization, skill development, company profitability, etc. Note that market-based pricing generally provides you with the upper end of an internal transfer price, not a mandatory one. Additional costs that may not be expressed in a market price-based transfer price include insurance, quality, reliability, transportation, etc.

Market-based transfer pricing is also referred to as arm’s length standards or transfer pricing. Tax authorities usually use market price-based methods to check if transactions are “fairly” valued for tax purposes.

Cost-Based Methods Offsetting Transfer Prices

Cost-based methods of transfer pricing between divisions or intra-company units include:

- The variable cost of production,

- The total cost of production,

- Variable production cost plus markup, and

- Total production cost plus a markup.

Cost-based methods seem to be based on logical principles and actual costs. However, cost-based methods may not correspond with market prices if a division is either very efficient or inefficient or given scale economies of market participants. Cost-based transfer pricing may seem unfair to certain participants if the market prices are considerably lower. Note that the cost-based transfer pricing method usually sets the lower end of the internal transfer price, not the upper price. When using cost-based transfer pricing methods, you could use the actual pricing or standard pricing or budgeted pricing to set transfer prices. There are pros and cons for each of these transfer pricing methods

Spare Capacity and Transfer Pricing

Existence of spare production capacity becomes an important consideration in establishing transfer pricing. If spare capacity exists, firms must usually prioritize the use of the spare capacity to increase efficiency and profitability. Transfer pricing must be designed to encourage internal transaction as far as possible to improve efficiency and profitability. Here the variable cost of production plus markup becomes a preferred transfer pricing policy.

Internal Versus External Books / Multiple sets of Books

Just like in the case of international transfer pricing, companies may end up with two or more sets of accounting books. One for internal managerial accounting reporting and another for external reporting and tax purposes.

Transfer Pricing Questions

Transfer pricing questions seen in case studies include:

- Given the case information, which transfer pricing system would you implement as the CEO of the firm?

- What are the advantages and drawbacks of the three transfer pricing systems advocated in the case?

- Why do many multinational firms use one set of transfer prices for internal reporting and another set for external reporting purposes?

- How is the U.S. tax code different from other countries in the way it taxes overseas income?

- What is Arm’s length standards for transfer pricing?

- How do tax authorities check if the transaction was valued fairly?

- What methods are adopted to comply with the arms’ length standard?

Transfer Pricing Resources/Case Studies

Some HBS articles and case studies that cover transfer pricing include:

- Case of the Tangled Transfer Price by M. Edgar Barrett (Product #: 77301-PDF-ENG)

- Control with Fairness in Transfer Pricing by Robert G. Eccles

- Strategic Transfer Pricing By: S. Datar and M. G. Alles

- Transfer Pricing with ABC By: Robert S. Kaplan, Dan Weiss and Eyal Desheh

Graduatetutor.com provides tutoring on a variety of transfer pricing topics and case studies. Please let us know if we can be of assistance.