Many of our students mix up the difference between sustainable growth rate and internal growth rate. We address the difference between sustainable growth rate and internal growth rate on this page.

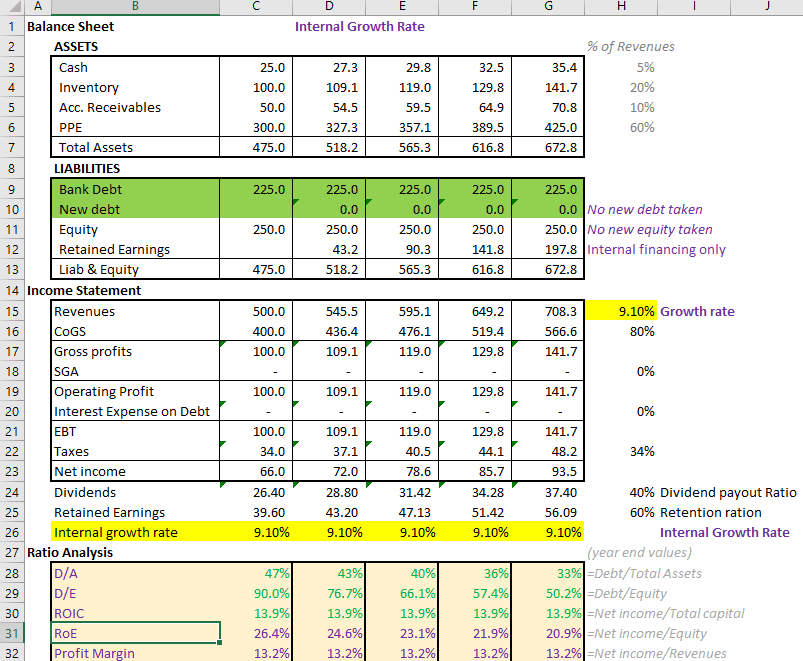

What is Internal Growth Rate?

The internal growth rate is the growth rate that the company can grow at without ANY external financing. The internal growth rate is the growth rate that the company can grow at by reinvesting its own earnings. Therefore, the internal growth rate is a function of the company’s earnings and the earnings it retains (retention ratio or payout ratio).

Example of a Firm Growing at the Internal Growth Rate

You can access the Microsoft Excel model of a firm growing at the internal growth rate here. You will see growth in revenues with no additional financing needed – no new debt was added and no new equity raised.

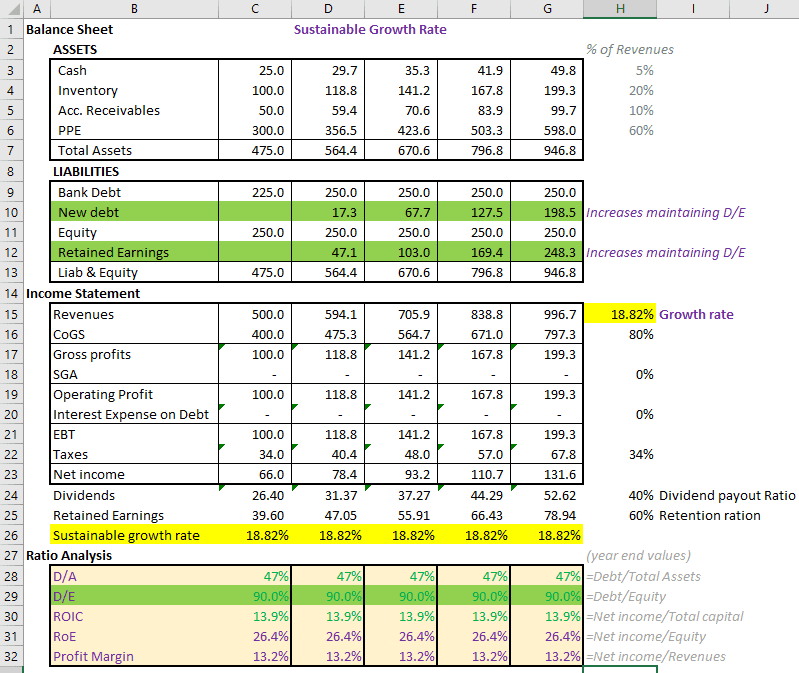

What is a firms Sustainable Growth Rate?

Sustainable growth is the growth rate that the company can grow using only debt financing but with the same capital structure. In other words, sustainable growth is the growth rate that the company can grow using debt but with the same debt to equity ratio. The increase in equity comes from the retained earnings. Debt is also added, but only to the extent, the debt to equity ratio does not change.

Example of a Firm Growing at the Sustainable Growth Rate

You can access the Microsoft Excel model of a firm growing at a sustainable growth rate here. You will see growth in revenues with no additional DEBT financing with the same capital structure: i.e., debt to equity ratio being maintained.

Related Questions in Private Equity and Investment Banking Interviews

Some examples from the members-only Private Equity and Investment Banking Interview community.

- When are the sustainable growth rates and operating income growth rates equal?

- Can use the sustainable growth rate equation to grow revenues? If not, how do you estimate revenue growth rates?

- Can you use the sustainable growth rate equation to grow operating income? If yes, what is the formula? If not, how do you estimate operating income growth rates?

- Will a company grow at the sustainable growth rate? Is that the growth rate I should use in my DCF valuation?

- How does the equation of sustainable growth rate feature in a DCF valuation?

- How does the reinvestment rate impact the value of a business in DCF valuation when the business is NOT profitable?