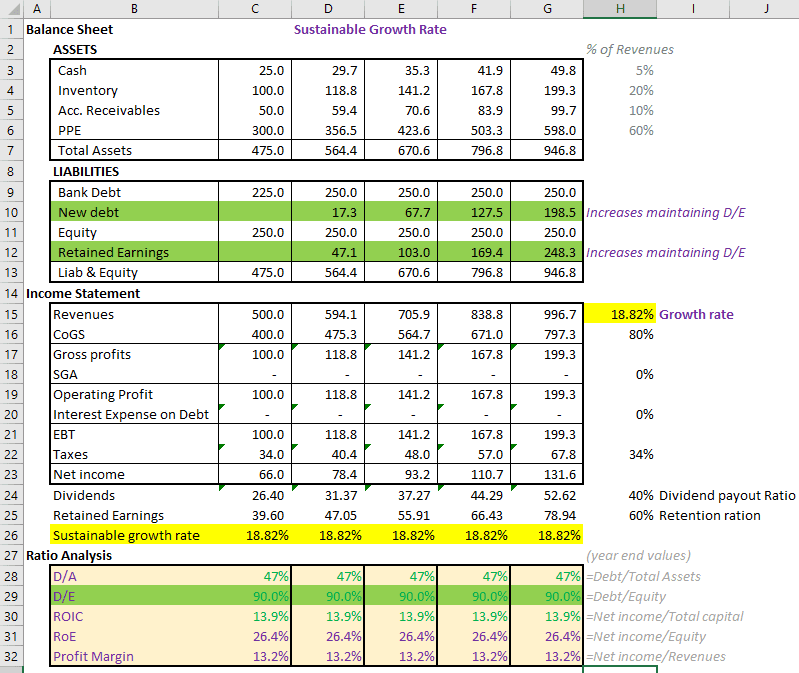

Sustainable growth is the growth a company can grow at given its profitability and reinvestment decisions without taking on additional debt. The equation for sustainable growth = Retention ratio* Return on Equity. And since the retention ratio is equal to 1- Payout ratio, sustainable growth is also = (1- Payout ratio) * Return on Equity. We understand what the sustainable growth rate is and its formula. Can I use the sustainable growth rate as my company’s operating income growth rate in the DCF valuation model?

There are two ways to answer this:

- No, you cannot use the sustainable growth rate equation to grow operating income. The primary reason is that the sustainable growth rate equation pertains to equity earnings or net income to shareholders or earnings per share. If you want to use the sustainable growth rate equation for the company’s revenues or operating income, you have to modify the equation to reflect components at the firm level.

- Yes, you can use the sustainable growth rate to grow operating income. However, remember that all other components must remain stable. You can access the Microsoft Excel model of a firm growing at a sustainable growth rate here. Note the operating and net income also grow at the same pace.