Finding and investing in “good companies” is the holy grail of investing. Some investors have done it over decades. This isn’t easy. What is even more difficult is to explain how to find and invest in ‘good companies’. Fundsmith LLP CEO Terry Smith’s 2021 investor letter has gone viral. And for good reasons. There is plenty of valuable gold in there. But what caught my idea was his idea of a “good company”!

What Makes a Company a Good Investment?

Many famous investors talk about why they get phenomenal returns. They try to explain why they pick some companies and not others. They try to explain that they invest in ‘good companies’ and how to find them. But it is not easy to understand or follow or implement! For example, Benjamin Graham liked micro-cap cigar-butt stocks. Warren Buffett wants to invest only in companies with a wide moat. Some like to call it a durable competitive advantage. Phil Fisher likes to invest in growth orientation stocks. Some stress the importance of environmental, social, and governance (ESG) factors in companies. Ark Investments manager Cathie Wood calls her to pick disruptive innovation stocks. Despite their best intentions, most have not clearly explained their picks.

Financial Metrics of Good Companies

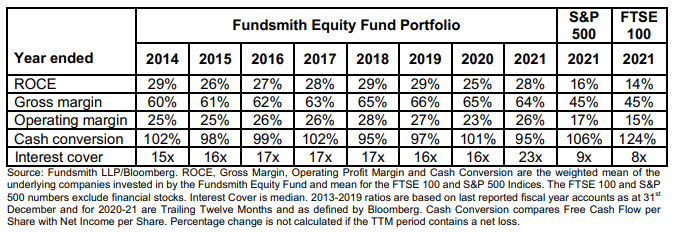

Terry Smith has clearly outlined the financial metrics that you can expect of a good company! Terry indicates that good companies should have good metrics even in poor years. He has laid out the following financial and operating metrics:

- RoCE

- Gross margins

- Operating margins

- Cash conversion

- Interest cover

Growth was another metric Terry Smith added to his definition of good company. Terry Smith wasn’t talking about revenue growth or growth in EPS. He emphasized his preference for growth in free cash flow after paying out all except dividends.

Comparable Metrics or Setting the Bar for Good Companies

Terry Smith’s 2021 investor letter lays out the metrics of his investments on a ‘look through basis. (defined below)

So How Can I Use This in My Equity Portfolio?

- First, analyze your portfolio. Compute the look through financials of your portfolio.

- Second, compute the above metrics for your portfolio.

- Then, commit to adding companies that will only increase the above ratios. This will improve the quality of your portfolio.

- Finally, consider removing any company in your portfolio that drags down your selected financial metrics unless there is a good reason to hold on to it.

I recommend reading Terry Smith’s entire letter. You can find it here. Has a wonderful track record. Lots to learn in there.

What are Look Through Earnings?

Look through earnings is a term invented or popularized by Warren Buffet in Berkshire’s owner’s manual. Let’s look at what Warren Buffet had to say:

We attempt to offset the shortcomings of conventional accounting by regularly reporting ‘look-through’ earnings (though, for special and nonrecurring reasons, we occasionally omit them). The look-through numbers include Berkshire’s own reported operating earnings … plus Berkshire’s share of undistributed earnings of our major investees—amounts that are not included in Berkshire’s figures under conventional accounting

“An Owner’s Manual,” distributed to Berkshire Hathaway Inc. Class A and Class B shareholders in 1996.

Warren Buffet also explains the rationale for computing look through earnings.

We have found over time that undistributed earnings of our investees, in aggregate, have been fully as beneficial to Berkshire as if they had been distributed to us (and therefore had been included in the earnings we officially report). This pleasant result has occurred because most of our investees are engaged in truly outstanding businesses that can often employ incremental capital to great advantage, either by putting it to work in their businesses or by repurchasing their shares. Obviously, every capital decision that our investees have made has not benefited us as shareholders, but overall we have garnered far more than a dollar of value for each dollar they have retained. We consequently regard look-through earnings as realistically portraying our yearly gain from operations.”

“An Owner’s Manual,” distributed to Berkshire Hathaway Inc. Class A and Class B shareholders in 1996.