Warren Buffett bought equity shares of Paramount Global. A great brand without a doubt. A number of operating units from CBS, Paramount, etc. Valuation seems relatively cheap in terms of EV/EBITDA or EV/sales. Reasonable margins and RoE or ROIC. Unpredictable growth? Maybe. But that is Warren’s expertise! Paramount Global has three classes of equity shares! Warren Buffett bought class B equity shares of Paramount Global (PARA)! But why did Warren Buffett buy Class B shares? Did he make a mistake in buying Class B shares? This question is what we analyze here.

PARA (Div 3%) vs. PARAP (Div 13%)- Different Classes of Equity Shares

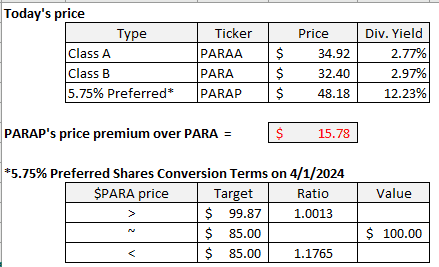

Paramount Global has three classes of equity shares! The convertible preferred equity (PARAP) gives you a dividend yield of 12.75% vs 2.97% for Class B shares! Not only does $PARAP give you a higher dividend it also converts into at least 1 PARA or class B share in 2 years. So why did Warren Buffett buy PARA over PARAP? Is this a mistake?

Convertible Preference Shares – Valuation Premium

As seen above, there is a $15.78 premium on the 5.75% Series A Mandatory Convertible Preferred Stock $PARAP.

So if you get a minimum 1.0013 class B shares in two years (possibly more) and you got a higher dividend why would do buy the preferred shares – even if there is a premium price!?

Is the $PARAP premium worth it!?

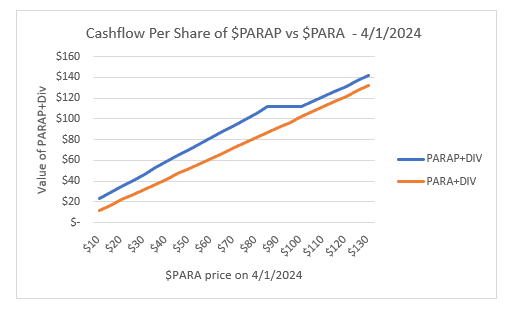

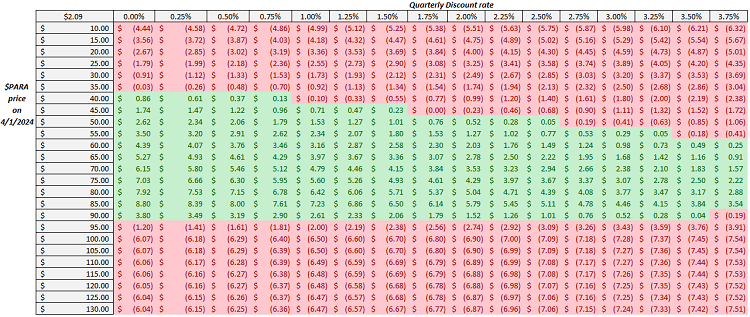

On April 1, 2024 the cashflows and payoffs look like this assuming the conversion terms for a range of PARA prices from $10 to $130.

It looks like PARAP is better than PARA from the above! What gives!? Did he make a mistake in buying Class B shares?

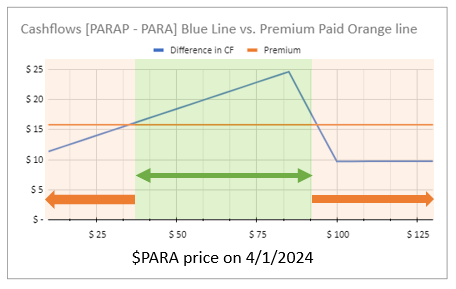

Not always! Here is what the cash flow analysis looks like.

Here is the link to the spreadsheet. What do you think? Please feel free to join the discussion on Twitter, Reddit or Ycombinator? Maybe we can do an incremental cash flow analysis!?

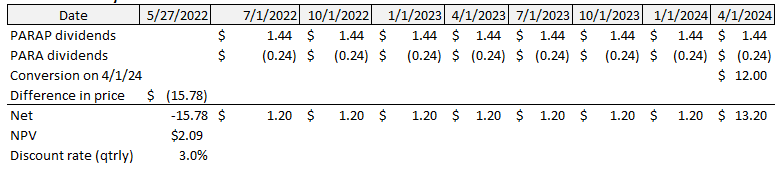

Incremental Cashflow Analysis

Here is the incremental cash flow analysis spreadsheet for your review. Clearly, we do not know what the price of $PARA is going to be on 4/1/2024. Nor do we know what the discount rate Warren Buffett is using. So we can run a sensitivity analysis on these two assumptions.

The resulting sensitivity analysis is here.

Non-Redeemable Mandatory Convertible Preferred Stock

Each convertible preferred equity share will

- Pay $5.75/year (12.75% dividend yield at today’s prices)

- Convert to a minimum of 1.0013 and a maximum of 1.1765 shares of our Class B Common Stock on April 1, 2024.

- Class B shares only pay a dividend of $0.96/year or 2.97% at today’s prices.

- Preferred Dividends are cumulative.

- Preferred Dividends have preference over common dividends.

Here is the link to the spreadsheet. What do you think? Please feel free to join the discussion on Twitter, Reddit or Ycombinator?

Conversion Terms on April 1, 2022

- if the Applicable Market Value of our Class B common stock is greater than the Threshold Appreciation Price, which was approximately $99.87, then the conversion rate will be 1.0013 shares of our Class B common stock per share of Mandatory Convertible Preferred Stock (the “Minimum Conversion Rate”);

- if the Applicable Market Value of our Class B common stock is less than or equal to the Threshold Appreciation Price but equal to or greater than the Initial Price, which was approximately $85.00, then the conversion rate will be equal to $100.00 divided by the Applicable Market Value of our Class B common stock, rounded to the nearest ten-thousandth of a share; or

- if the Applicable Market Value of our Class B common stock is less than the Initial Price, then the conversion rate will be 1.1765 shares of our Class B common stock per share of Mandatory Convertible Preferred Stock (the “Maximum Conversion Rate”).

More details on the 5.75% Series A Mandatory Convertible Preferred Stock from the Paramount Global 2021 10K.

Background – Mandatory Convertible Preferred Stock

On March 26, 2021, we completed offerings of 20 million shares of our Class B Common Stock at a price to the public of $85 per share and 10 million shares of 5.75% Series A Mandatory Convertible Preferred Stock at a price to the public and liquidation preference of $100 per share, resulting in an aggregate liquidation preference of $1 billion. The net proceeds from the Class B Common Stock offering and the Mandatory Convertible Preferred Stock offering were approximately $1.67 billion and $983 million, respectively, in each case after deducting underwriting discounts, commissions and estimated offering expenses. We have used and intend to continue to use the net proceeds for general corporate purposes, including investments in streaming.

Conversion Terms – 5.75% Series A Mandatory Convertible Preferred Stock

Unless earlier converted, each share of Mandatory Convertible Preferred Stock will automatically and mandatorily convert on the mandatory conversion date, expected to be April 1, 2024, into between 1.0013 and 1.1765 shares of our Class B Common Stock, subject to customary anti-dilution adjustments. The number of shares of Class B Common Stock issuable upon conversion will be determined based on the average of the volume-weighted average price per share of our Class B Common Stock over the 20 consecutive trading day period commencing on, and including, the 21st scheduled trading day immediately preceding April 1, 2024. Holders of the Mandatory Convertible Preferred Stock (“Holders”) have the right to convert all or any portion of their shares of Mandatory Convertible Preferred Stock at any time prior to April 1, 2024 at the minimum conversion rate of 1.0013 shares of our Class B Common Stock. In addition, the conversion rate applicable to such an early conversion may, in certain circumstances, be increased to compensate Holders for certain unpaid accumulated dividends. However, if a fundamental change (as defined in the Certificate of Designations governing the Mandatory Convertible Preferred Stock) occurs on or prior to April 1, 2024, then Holders will, in certain circumstances, be entitled to convert all or a portion of their shares of Mandatory Convertible Preferred Stock at an increased conversion rate for a specified period of time and receive an amount to compensate them for unpaid accumulated dividends and any remaining future scheduled dividend payments. The Mandatory Convertible Preferred Stock is not redeemable. However, at our option, we may purchase or otherwise acquire (including in an exchange transaction) the Mandatory Convertible Preferred Stock from time to time in the open market, by tender or exchange offer or otherwise, without the consent of, or notice to, Holders. Holders have no voting rights, with certain exceptions.

If declared, dividends on the Mandatory Convertible Preferred Stock are payable quarterly through April 1, 2024. Dividends on the Mandatory Convertible Preferred Stock accumulate from the most recent dividend payment date, and will be payable on a cumulative basis when, as and if declared by our Board of Directors, or an authorized committee thereof, at an annual rate of 5.75% of the liquidation preference of $100 per share, payable in cash or, subject to certain limitations, by delivery of shares of Class B Common Stock or through any combination of cash and shares of Class B Common Stock, at our election. If we have not declared any portion of the accumulated and unpaid dividends by April 1, 2024, the conversion rate will be adjusted so that Holders receive an additional number of shares of our Class B Common Stock, with certain limitations