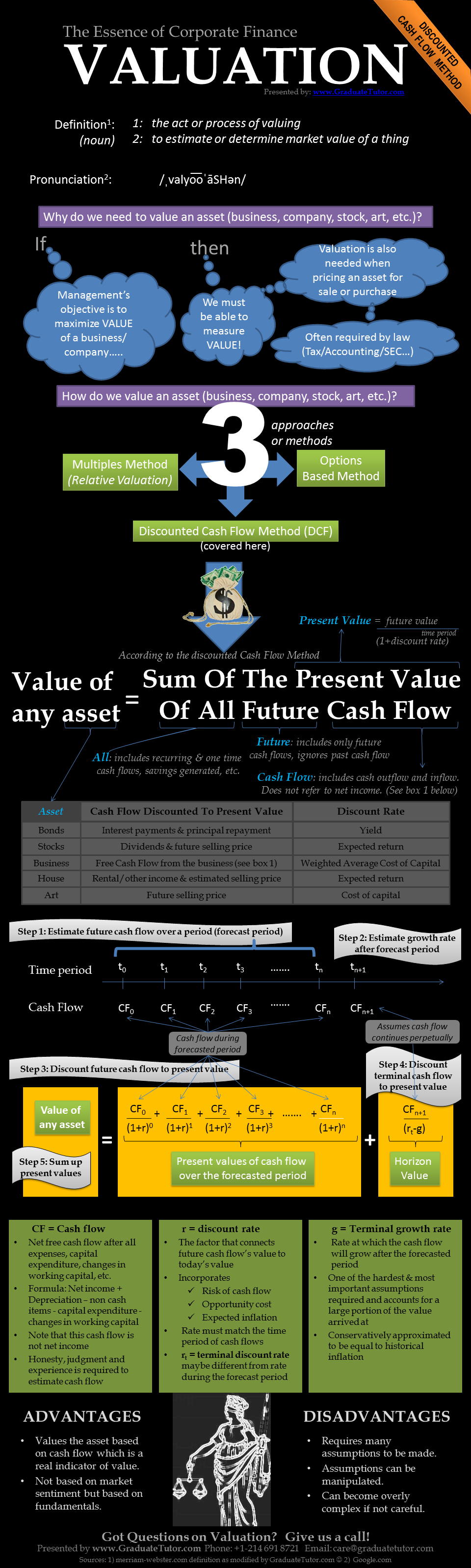

The primary objectives of management and corporate finance teams should be to maximize or increase shareholder value. To increase value, you must be able to measure value. Thus ‘valuation’ becomes a critical function of the corporate finance team in any organization.

There are many ways to value a company but the most common methods of valuing a company are the discounted cash flow method, multiples based valuation and options based valuation. This infographic addresses valuation using the discounted cash flow method. The discounted cash flow method of valuation essentially values a company or asset at today’s value of all future cash flows that will be generated from that company or asset.

Discounted Cash Flow Valuation Infographic – An infographic by the finance tutoring team at GraduateTutor.com.

Discounted cash flow method can be used in the valuation of a project, company or another asset. Discounted cash flow method is a valuation process involving concepts such as time value of money, present & future cash flows, etc. The abbreviation of discounted cash flow given that is often heard in the corporate finance world is DCF. Graduate Tutor’s Finance Homework help group can tutor you discounted cash flow and topics related to discounted cash flow. Other topics related to discounted cash flow that our finance tutors tutor on are listed below:

- Discounted cash flow

- Cash Flow

- Present value

- Net present value

- Future value

- CAPM

- WACC

Graduate Tutor’s expert tutors consist of MBA, CPAs or CFAs who can provide you discounted cash flow homework help tutoring in addition to other finance tutoring. Email us for more information.