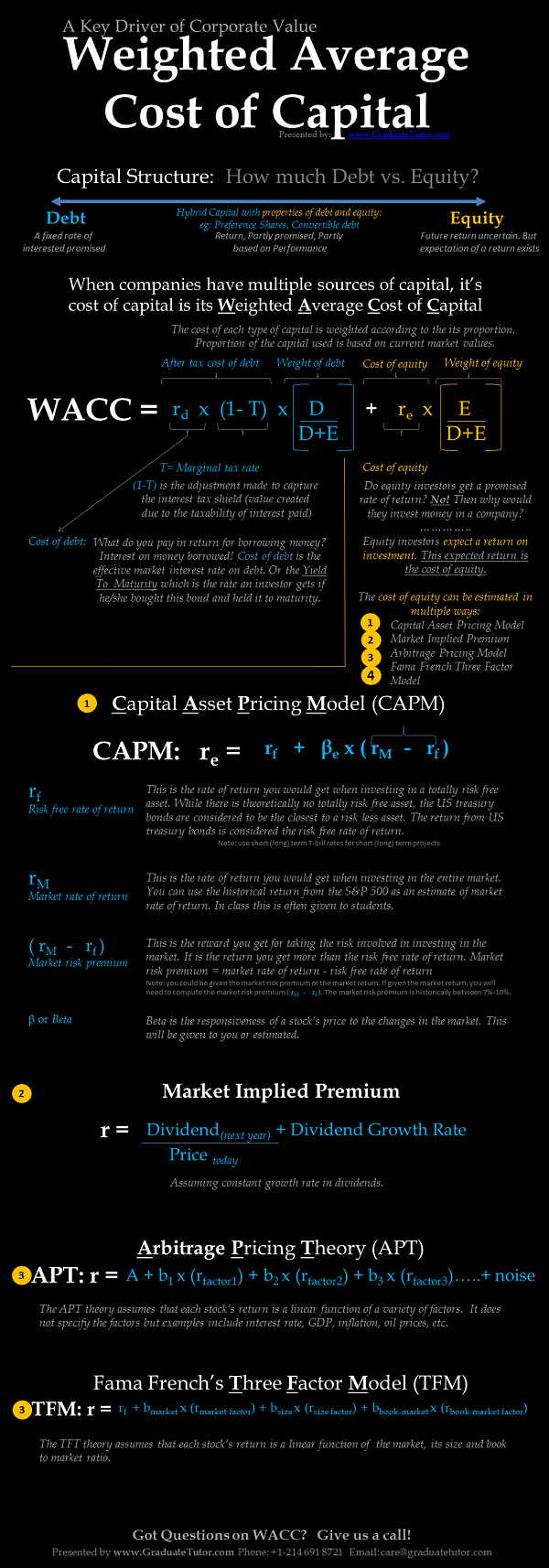

The Weighted Average Cost of Capital (WACC) kind of averages the costs of the different types of capital a company or project uses in proportion to its weights. We have tried to illustrate this visually in an info-graphic.

The two most important aspects to keep in mind are:

1) the market values of debt and equity must be used to weight the costs of different types of capital; and

2) the tax benefit of debt (tax shield) is captured but multiplying the rate of debt by (1-t) on the debt side of The Weighted Average Cost of Capital (WACC) formula.

Please feel free to use this info-graphic on your website. However, do give us credit by linking to this page as its source.

Weighted Average Cost of Capital – WACC – An infographic by the Finance tutoring team at Graduatetutor.com

Embed Weighted Average Cost of Capital – WACC in an Infographic on Your Site: Copy and Paste the Code Below

Please feel free to use this info-graphic on your website. However, do give us credit by linking to this page as its source.

WACC Formula in Corporate Finance

Weighted average cost of capital is the rate at which a company is expected to pay in order to finance its assets.

Weighted average cost of capital or WACC is calculated using the following formula

Where:

- Re = cost of equity

- Rd = cost of debt

- E = market value of the firm’s equity

- D = market value of the firm’s debt

- V = E + D

- E/V = percentage of financing that is equity

- D/V = percentage of financing that is debt

- Tc = corporate tax rate

Graduate Tutor’s finance tutors can assist you understand weighted average cost of capital and other topics related to WACC. Sample topics that our corporate finance tutors can assist you include:

- Cost of capital

- Cost of debt

- Cost of equity

- Discount rates

- Market value

Capital Asset Pricing Model Homework help & Tutoring

Capital asset pricing model is a financial model. Capital asset pricing model is a model to perform asset pricing. Capital asset pricing model is used in the analysis of the relationship between risk and rates of return in securities.

Capital asset pricing model is widely used in the field of finance. Capital asset pricing model is crucial to business school students too!

Graduate Tutor’s Finance Homework help group can tutor you Capital asset pricing model and topics related to Capital asset pricing model.

Capital asset pricing model can be calculated using the formula that follows

Capital asset pricing model is also written as CAPM. Capital asset pricing model has a great number of applications in finance!

Our tutors are MBAs, CPAs or CFAs who can provide you weighted average cost of capital homework help tutoring in addition to other finance tutoring. Email us for more information.