Companies can either buy or lease assets it needs on a long-term basis. For example, a firm can buy a truck required for the business or lease the truck. A company usually leases a long-term asset if it either 1) does not have the money to buy it and 2) does not want to borrow the capital required to buy these assets. The business case should be the driver of this decision. Sometimes, companies may lease the asset because it does not have money to buy the asset or wants to avoid taking on more debt. The SEC has prescribed accounting rules that specify the conditions required to treat a lease as an operating expense or a capital item. SEC regulations aside, we address how you should deal with operating leases when preparing cash flows for a DCF on this page.

The SEC has prescribed accounting rules that specify the conditions required to treat a lease as an operating expense or a capital item.

- The lease transfers ownership of the property to the lessee by the end of the lease term;

- The lease contains a bargain purchase option;

- The lease term is equal to 75% or more of the estimated economic life of the leased property. However, if the beginning of the lease term falls within the last 25% of the total estimated economic life of the leased property, including earlier years of use, this criterion shall not be used for purposes of classifying the lease; and

- The present value of the minimum lease payments, excluding that portion of the payments representing executory costs such as insurance, maintenance, and taxes to be paid by the lessor, including any profit thereon, equals or exceeds 90% of the excess of the fair value of the leased property to the lessor.

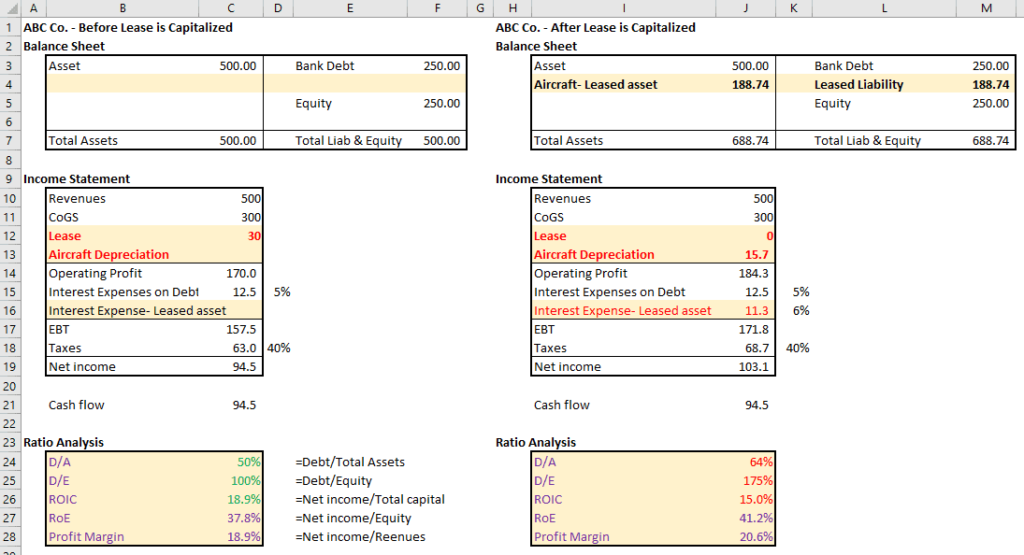

In principle, if an operating lease is genuinely an operating expense, it must continue to be shown as an expense and treated accordingly. However, if it was structured to avoid taking on debt, it must be capitalized. Capitalized simply means that it must be treated as a capital asset.

In practice, you must capitalize the operating lease and asset in accordance with the rules prescribed by the SEC. We address the steps required to capitalize an operating lease in another question here.

You can see an illustration of the steps required to capitalize an operating lease in Microsoft Excel here too.