Business cycles are part and parcel of life in certain industries. An excellent example of industries that have cycles is commodities. Another example is the shipping industry. Are these business cycles considered abnormal events? Are they required to be normalized? If they are to be normalized, how do you normalize them?

Yes, you must account for business cycles if the business you are going to value is cyclic in nature. This is because we want to reflect reality as accurately as possible. This means that if the business is cyclic, you want it to show up in your cashflows and DCF model.

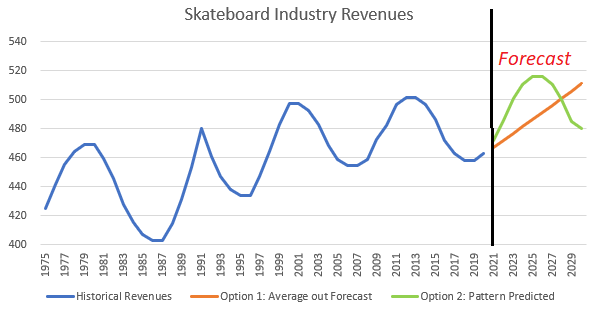

You can reflect the cyclic nature of the business in two ways. You can either 1) take the average cash flows over a cycle and grow it at expected rates or 2) model out the cyclic nature over a cycle that may be 5 to 15 years long.

PS: another critical point when you are modeling business cycles is to ensure you have forecasted cash flows for at least one entire cycle period, if not more, in the DCF model!

In the example below, it looks like a cycle length is approximately 10 years. So you should forecast at least 10 years in your DCF valuation forecast. Either option is OK. You can access the example Microsoft Excel file here.