Companies can either buy or lease assets it needs on a long-term basis. For example, a firm can buy a truck required for the business or lease the truck. A company usually leases a long-term asset if it either 1) does not have the money to buy it and 2) does not want to borrow the capital required to buy these assets. The business case should be the driver of this decision. Sometimes, companies may lease the asset because it does not have money to buy the asset or wants to avoid taking on more debt.

Accounting rules specify the conditions required to treat an operating lease as a capital lease and capitalize it. What impact does capitalizing an operating lease have on the balance sheet?

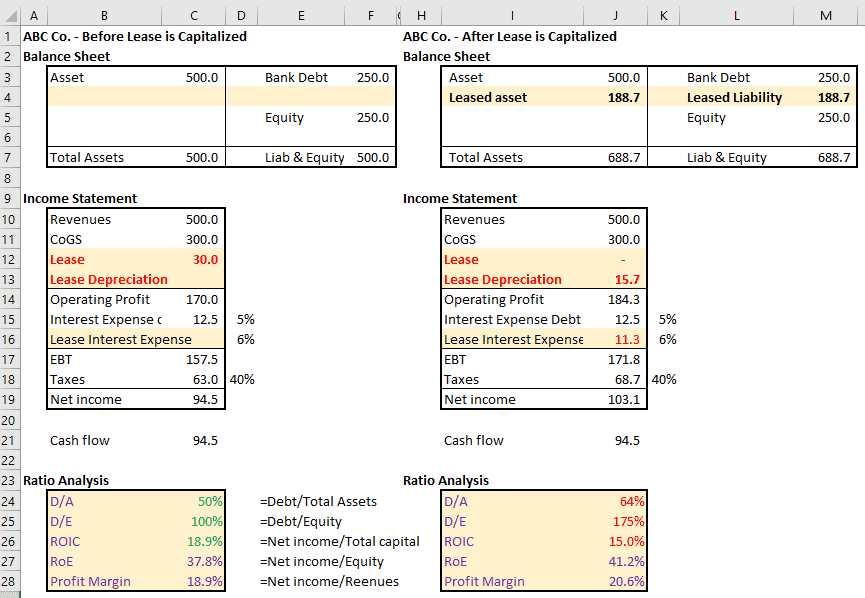

Capitalizing an operating lease on the balance sheet causes the following changes:

- Addition of a leased asset to the assets side of the balance sheet;

- Addition of a leased asset LIABILITY to the liabilities side of the balance sheet; and

- Changes in shareholders equity as a result of changes to the income statement (removal of operating lease expense, addition of leased asset depreciation and interest expense on leased asset liability).

An example of the impact on financial statements can be seen in this example below.

Note the changes in the financial ratios.

The Microsoft Excel model can be accessed here. Feel free to change the lease numbers and see how it impacts the financial statements.