The value of any asset is equal to the present value of all future cash flow is the concept being relied on when valuing a firm using the DCF valuation method. Does the interest rate factor in your model? If so, how does the interest rate factor in your model? There are at least two ways the interest rates are accounted for in a DCF valuation model.

We discuss the different ways interest rates can factor into your DCF valuation model on this page.

The first way in which interest rates factor into a DCF model is through the discount rate. The discount rate captures the rate at which the value of money declines. Prevailing interest rates are a big factor in opportunity cost. And opportunity cost is an ingredient of the discount rate.

The CAPM method of estimating the discount rate includes the risk-free rate as the starting point.

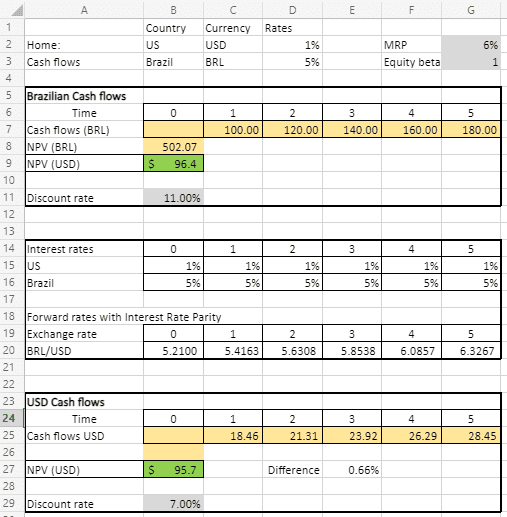

International valuation involves converting foreign currency cashflows into the valuation or base currency. This is another situation where interest rates will be factored into the valuation. The forecasted foreign currency should be ideally converted at rates consistent with the interest rate parity concept. Below is an illustration of the concept using simple numbers. We have valued a Brazilian firm assuming the home country is the US. The forward exchange rates used adheres to the interest rate parity concept. You can access the excel file here.

You will note that the valuation in USD and Brazilian Real is approximately the same (difference of only 0.66%).