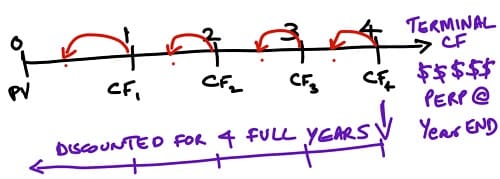

The present value concept discounts the cash flows of a period by the entire period using the discount rate. The DCF valuation method relies on the present value concept to value the cash flows of a business. Therefore the DCF valuation method also discounts the cash flows of a period by the entire period using the discount rate. However, this may not be an appropriate reflection of reality. Thus enters the midyear convention. It maybe appropriate to use in specific industries and companies.

However, the midyear convention should have no impact on discounting the terminal value.

The midyear convention assumes that the cash flows are evenly distributed during the year. This is fine for the cash flows received during the forecast period.

However, the terminal value is the value of all terminal cash flows at the end of the last year/forecast period. The terminal value is arrived at using the perpetuity formula or assuming that the business is sold at the end of the forecast period. Since this value is at the end of the forecast period, the midyear convention should NOT be applied to the terminal value. Therefore, the midyear convention should have no impact on the terminal value.