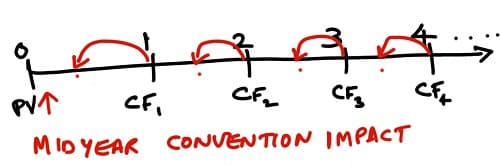

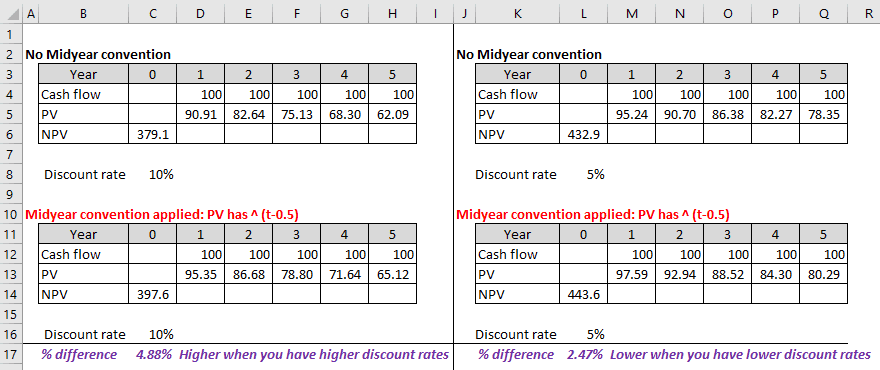

The present value concept discounts the cash flows of a period by the entire period using the discount rate. The DCF valuation method relies on the present value concept to value the cash flows of a business. Therefore the DCF valuation method also discounts the cash flows of a period by the entire period using the discount rate. However, this may not be an appropriate reflection of reality. Thus enters the midyear convention.

The midyear convention is an assumption that cash flows occur in the middle of the year.

Most DCF models assume that cash flows occur at the end of the year. This assumption causes the entire cash flows for the year to be discounted by a full year. A business whose cash flows occurs evenly during the year is penalized when you discount all its cash flows for an entire year. The midyear convention takes the year’s midpoint as the point in time that the year’s cash is received. The midyear convention discounts the first half of the period more than it should and the second half of the period less than it should – thereby averaging it evenly. The midyear convention makes the midyear convention closer to reality and a better assumption for most companies.

A typical example of a business/industry for whom the midyear convention will be appropriate will be the real estate industry. This is because the cash flows – rental income – flow evenly during the year. Another example may be the ice cream industry’s cash flows happen more during the middle of the year, so it does not make sense to discount the cash flows by a full year.

You can access the Microsoft Excel Model here. In addition, here is another article on the midyear convention if you are looking to read more on this topic.