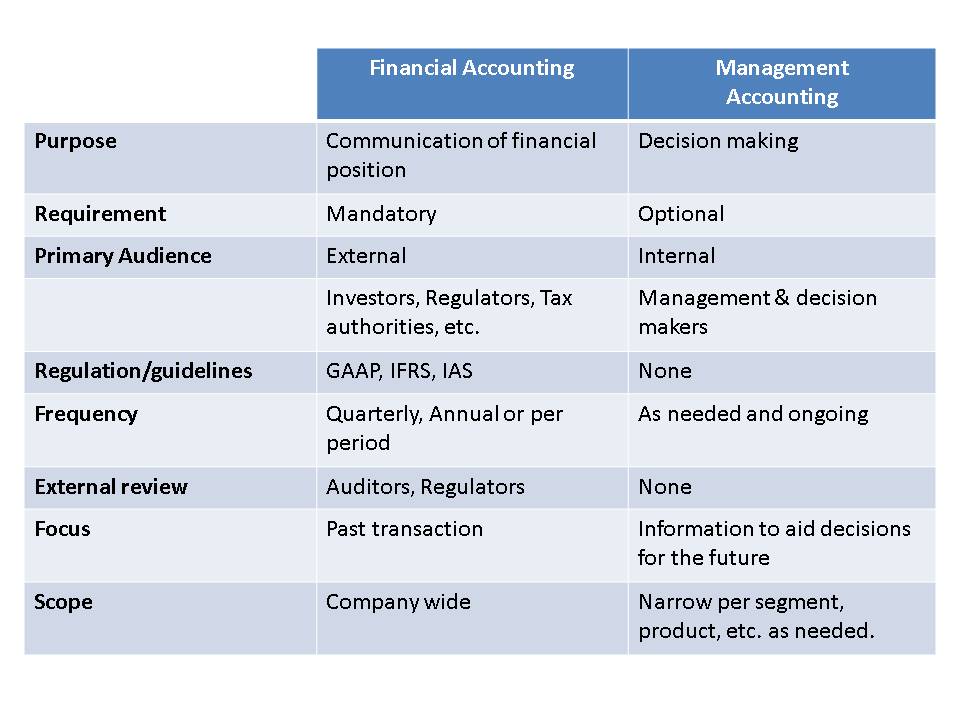

We get asked by students about the difference between financial accounting and managerial accounting. The average business school student will be exposed to both financial accounting and managerial accounting concepts during their program. Often both financial accounting and managerial accounting may be taught in the same course and so many students are unclear about the difference between financial accounting and managerial accounting. Financial accounting and managerial accounting are definitely closely related and mix well but there is clearly a difference between financial accounting and managerial accounting.

Financial Accounting

Financial accounting is what most people think of when they envision the accountant at work. Financial accounting is concerned with the principles, practices and systems employed to compile transactions of an entity and present financial information for use by an entity’s internal and external stakeholders. An entity’s internal and external stakeholders include the entity’s employees, managers, owners, creditors, suppliers, customers and regulators. Presenting specified financial information in prescribed formats and under specified guidelines to stakeholders is a mandatory requirement of the law. The financial information that financial accounting captures is usually presented as financial statements to an entity’s internal and external stakeholders. These financial statements include:

- the Balance Sheet, which reports the entity’s financial condition at a specific point in time;

- the Income Statement, which reports its operating results over a span of time;

- a Statement Of Cash Flows, which reports its cash inflows and outflows for a variety of activities over a span of time; Statement of Equity; and

- Explanatory notes to those financial statements that provide the reader with insight into the reported amounts.

Notably, all of these statements report the entity’s past activities. An independent entity generally audits financial accounting information, especially the information that a publicly-traded company reports, in order to provide the company’s external stakeholders with some assurance that the information is accurate.

The entity’s accountants prepare these statements in accordance with some form of generally accepted accounting principles (GAAP); these may be either country-specific (such as the United States GAAP or Japan GAAP) or International Financial Reporting Standards. An independent standard-setting organization generally creates and promulgates these standards; for example, the Financial Accounting Standards Board promulgates United States GAAP for for-profit entities while the Government Accounting Standards Board promulgates GAAP for not-for-profit entities and state and local governments and the Federal Accounting Standard Advisory Board promulgates GAAP for the Federal Government.

Topics Covered in Financial Accounting

A number of topics are covered when you study financial accounting. Depending on the level of the course a student is taking (introductory accounting, intermediate or advanced accounting, professional course, etc) these topics may be covered in more depth. Generally the topics covered include topics:

- Accounting Principles

- Bookkeeping Rules, Processes and Formats

- Understanding the Chart of Accounts

- Bank Reconciliation

- Financial Ratio Analysis

- Recognizing, Valuing and Presenting Asset Accounts

- Inventory Accounting

- Working Capital

- Recognizing and Presenting Liabilities

- Equity Accounting

- Payroll Accounting

- Receivables & Bad Debts Accounting

- Revenue Recognition Principles

- Taxation

The topics covered in managerial accounting are quite different. However a student may need to understanding these topics to a limited extend to be able to really understand managerial accounting.

Professional Qualifications of a Financial Accountant

While a financial accountant need not be licensed or certified to perform most financial accounting roles, those holding a Certified Public Accountant (CPA) designation are generally considered to be experts at for-profit as well as not-for-profit and state and local government financial accounting and reporting standards. The American Institute of Certified Public Accountants develops the content for the Uniform CPA Examination and scores each examination. The Uniform CPA Examination tests a candidate’s knowledge of and skill in auditing and attestation standards and procedures, the businesses reasons for and accounting implications of various types of business transactions, generally accepted accounting principles, and federal taxation, professional ethics and business law. CPAs are licensed by states and each state imposes a unique set of education and experience requirements on candidates for licensure; however, it has become easier for CPAs to transfer their licenses between states as more states have adopted the Uniform Accountancy Act. CPAs meet strict ethical standard and are required to complete continuing education courses, including those in ethics, in order to renew their licenses to practice accounting.

Management Accounting or Cost Accounting

Management accounting which is also referred as cost accounting is not a mandatory requirement of the law. Unlike financial accounting, an entity’s accountants practice managerial accounting in order to help its managers make business decisions that affect the entity’s future profits and cash flows. The accountants analyze the financial aspects of the entity’s operations and draw conclusions regarding their efficiency and effectiveness. Managerial accountants perform a wider gamut of analyses than do financial accountants, including analyzing the profit contributed by different products or business segments of an entity; the effect on profits of changing the entity’s cost structure (e.g. replacing fixed expenses such as sales salaries with variable costs such as sales commissions); the minimum number of units that an entity must sell in order to achieve a $0 net operating profit (the “break-even point”); or the effect on the entity’s owners’ wealth of engaging in a given project (e.g. net present value, internal rate of return, payback period, profitability index, etc.). Because managerial accounting reports are generally unique to a given entity, there are no standard reporting formats or accounting or reporting principles that guide them. Furthermore, they are generally not audited by an independent entity because outside stakeholders do not rely upon them; however, the entity’s internal auditors may review the reports as part of their responsibilities.

Topics covered in Management Accounting

- Product Costing

- Cost Accumulation

- Process Costing

- Activity Based Costing (ABC analysis)

- Cost Behavior

- Cost Estimation

- Cost-Volume-Profit (CVP) Analysis

- Absorption Costing

- Variable Costing

- Standard Costing

- Flexible Budgeting

- Relevant Costing

- Cost Management Tools

Professional Qualifications of a Management Accountant

Though they need not be licensed or certified, most management accountants belong to the Institute of Management Accountants (IMA) and adhere to its Statement of Ethical Professional Practice. Certified Management Accountants (CMAs) are considered to be experts in management accounting. They must demonstrate their expertise in financial reporting, planning, performance, and control; and financial decision making (including professional ethics) by passing a rigorous two-part examination, holding a bachelor’s degree from an accredited college or university, being a member of the IMA, and having at least two years of experience in management accounting or financial management. They must complete continuing education classes, including those in ethics, in order to retain their certifications.

Conclusion on Difference between Financial Accounting and Managerial Accounting

Financial accounting is concerned with the principles, practices and systems employed to compile transactions of an entity and present financial information for use by an entity’s internal and external stakeholders. Managerial accounting on the other hand is done to help its managers make business decisions that affect the entity’s future profits and cash flows. Understanding both financial accounting and managerial accounting is crucial to have a well developed understanding of business for a management executive. The average business school student will be exposed to both financial accounting and managerial accounting concepts during their program, including those involving budgeting and long-term financial planning. The average student majoring in Accounting will complete courses not only in financial accounting and managerial accounting but also other topics such tax accounting (or taxation), auditing, international taxation, MIS, etc.