There are different methods to estimate terminal value in a DCF valuation. The perpetual growth rate method is the most common approach. Other methods include a multiple of earnings, cash flows, or revenues or less common methods such as orderly liquidation value; or a fire sale value. The method you chose depends on the stage of the company and expected growth drivers as well as the information available.

The perpetual growth rate method is the most common approach. However, the perpetual growth rate is usually assumed to be a positive value. Can the terminal growth rate in a perpetual growth rate method be negative? Why or Why not?

For example, if you have a reasonable estimate of terminal growth, the perpetual growth rate method may be good.

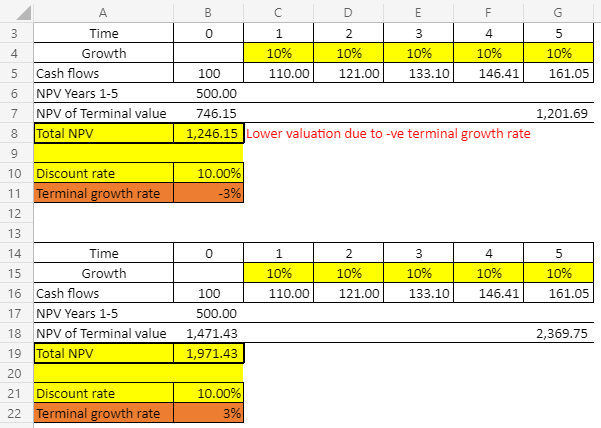

Yes, the terminal growth rate in a perpetual growth rate method can be negative. Negative terminal growth rates are appropriate for companies with declining revenues and/or cash flows.

Here is an example in a Microsoft Excel worksheet.