Off-balance sheet financing, as the name indicates, is a type of financing. It is more like debt than equity because there is no ownership, and the interest cost is baked into the monthly or quarterly payments being made. What happens to valuation when off balance sheet financing is added to the debt when computing WACC?

Does valuation go up? Or go down? We address this question: “What happens to valuation when off-balance sheet financing is added to the debt?” on this page.

You increase your valuation when off-balance-sheet financing is added to the debt when computing WACC. This is because you increase the weight of debt in your WACC when off-balance-sheet financing is added to the debt. And because debt is cheaper than equity, your WACC will decrease increasing the present value of your cash flows and therefore your valuation.

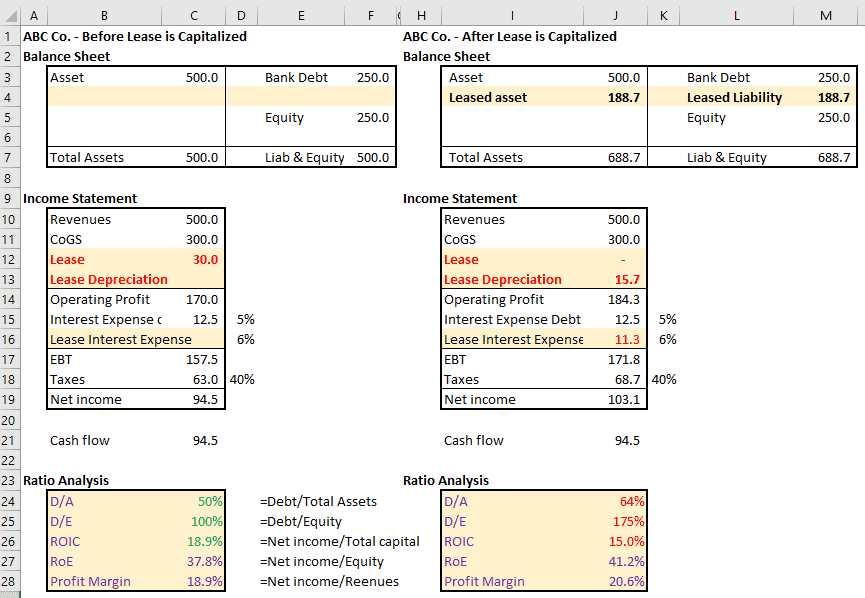

An illustration with leases the impact in a Microsoft Excel model can be accessed here. Feel free to change the lease numbers and see how it impacts the financial statements. See the impact of ratios.