Off-balance sheet financing is used by companies under different circumstances. In your valuation, understanding off-balance sheet financing is important for multiple reasons. Off-balance sheet financing influences the discount rate used in a DCF valuation model – often the WACC. And the WACC has an outsized impact on the value of the business! So, getting the discount rate or WACC right is important. A key ingredient of the WACC computation is the weight of debt. Students are often not sure what is included in debt as there are several ways companies can finance their capital needs including accounts payables, notes payables, off-balance sheet liabilities, collataralization, etc. We address this question ” Where does off-balance sheet financing figure when computing WACC? Is it considered debt?” on this page.

Off-balance sheet financing, as the name indicates, is a type of financing. It is more like debt than equity because there is no ownership, and the interest cost is baked into the monthly or quarterly payments being made.

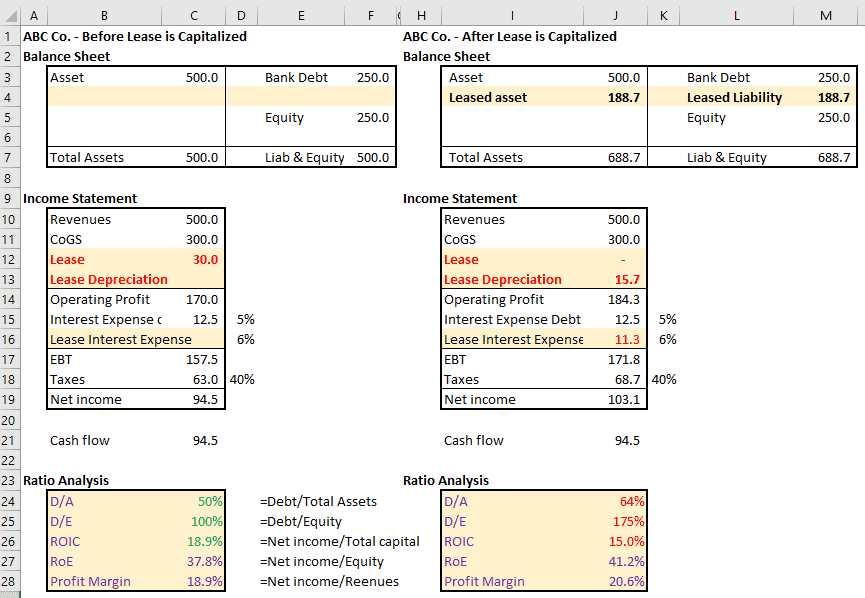

In estimating WACC, you are estimating the cost of capital and so want to figure out the proportion of total financing funded by debt. Since off-balance sheet financing is a type of financing, it should be considered as debt and treated accordingly.

The Microsoft Excel model can be accessed here. Feel free to change the lease numbers and see how it impacts the financial statements. Note the impact on debt to equity ratios.