You need the value of debt to arrive at WACC. If a company’s debt is publically traded, the value of the debt can be computed using the market price of the debt. But how do you get the market value of debt if a company’s debt is partly or fully bank debt (not publicly traded)?

You have two options. First, as a shortcut, to value debt if a company’s debt is partly or fully bank debt and not traded is to use the book value of debt as its market value. The rationale is that unless a company is on the verge of bankruptcy, the value of the debt will not be higher than the book value.

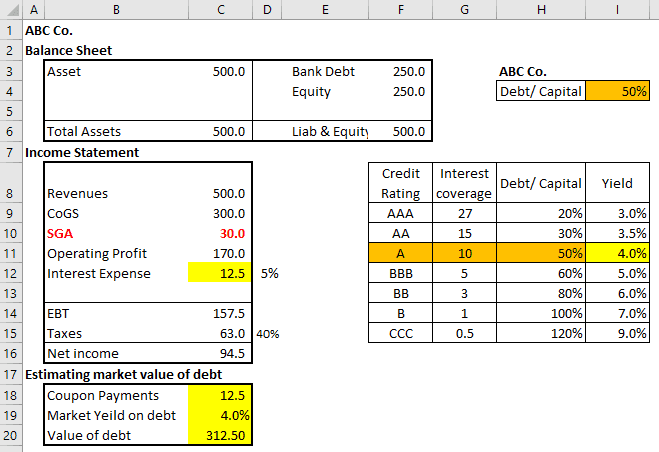

A second method, one that is more robust, to value debt if a company’s debt is partly or fully bank debt and not traded is to use the synthetic debt ratings. The company’s financials can be used to arrive at the company’s synthetic debt ratings. The synthetic debt ratings will give you an estimate of the interest rate spread or interest rates. These interest rates can be applied on the actual interest payments being made to arrive at the value of debt.

Illustration of the second example.

You can access this excel file to see how the market yield on debt (given the company’s credit ratings) was used to estimate of the current market value of debt.